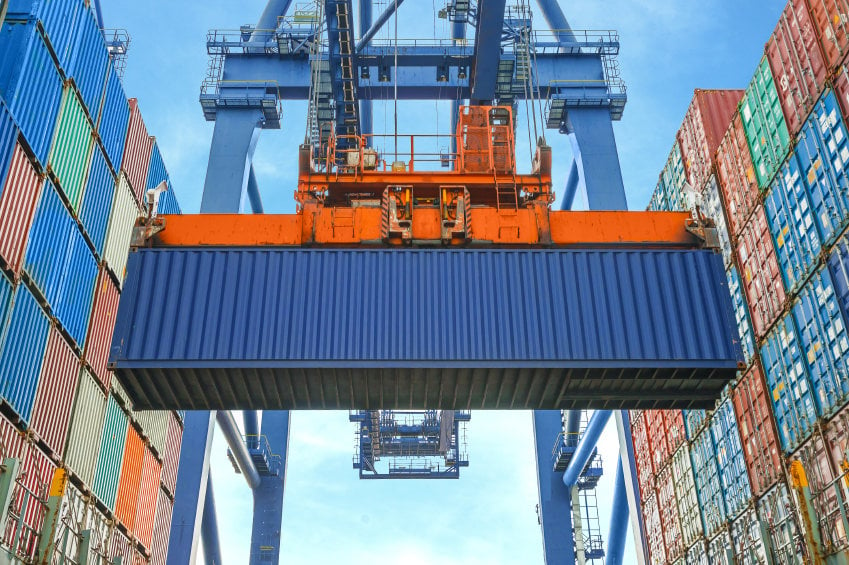

As we all know, LA and LB ports are experiencing a logistical nightmare which may weaken the competitiveness of the region’s economy. The congestion arises from a surge of cargo before the holidays, the ascending of massive container ships that filled the docks with cargo and the chassis shortage in the ports.

While a dozen or more factors are adding to the congestion in one way or another, returning to normalcy at the terminals first requires a resolution of the problem. So today, my focus will be on the shortage of trailers that truckers use to haul cargo from the ports to expending warehouses.

As per terminal operators, the shortage is a big dilemma that has devastated the industry. Truckers are losing too much time and money delivering a container at one terminal and a chassis somewhere else.

Steamship lines in the U.S. have been administering the chassis for trucking companies and cargo owners since the early days of containerization in the 1960s. The U.S. is the only country in the world where ocean carriers provide the equipment, but after losing a lot of money for purchasing, managing and maintaining their chassis fleets, they began selling their assets to leasing companies especially after the Great Recession. The transition didn’t go well at the two of the largest U.S. gateways; Los Angeles-Long Beach and New York-New Jersey.

Terminals periodically run short of the item during the rush hours and face other problems such as out-of-service chassis and billing issues. For five years, the industry has been struggling to adjust to the changes ocean carriers released. So once they transferred most of their chassis to leasing companies and quit providing customers free equipment, it bundled the whole service.

The busiest container gateways in East and West coast of the United States are trying to find a solution for the current situation but it seems like it will not be easy. It’s getting worse and may cause a gridlock if it is not addressed immediately and aggressively. In order to ease the current situation, the four companies that control about 95 percent of the chassis at Los Angeles and Long Beach agreed on to establish a fair-minded, gray chassis pool for the largest port complex in the Americas and to launch a phased implementation of the new model on Feb. 1, 2015.

With this concept, the goal is to advance and implement a program to provide interoperability of chassis among the equipment providers with the guidance of legal counsel. Gray chassis pool attendees, included the three largest pool operators in the harbor, Direct Chassis Link which has approximately 30,000 of the items, TRAC Intermodal which has 37,000 and Flexi-Van has 19,000, as well as SSA Marine with 9,000 which operates three container terminals and has its own pool.

The agreement will allow the ports to cooperatively argue a number of issues related to safety, security, infrastructure, congestion and equipment. So when a trucker pulling a container and chassis, can pick up or deliver the equipment at any of the 13 terminals in the harbor without regard to which pool serves a particular shipping line or terminal. A third-party company will take care of back office services, including billing.

Parties believe it will work well and ease the current situation at the ports. Gray pools will allow chassis to be interchanged freely and possibly stored off-dock instead of at terminals which will provide the ability of chassis to move freely in terms of start and stop locations.