According to Datamyne, NVOCCs’ market share within the U.S. maritime import market has increased to 39% (as of June 2017) from 26.5% over the last decade. Ocean carriers’ service levels are negatively correlated with the overall market share increase of NVOCCs. As more NVOCCs have entered the market, ocean carriers’ service levels have plummeted.

What has changed over the past decade that has affected ocean carriers’ service levels?

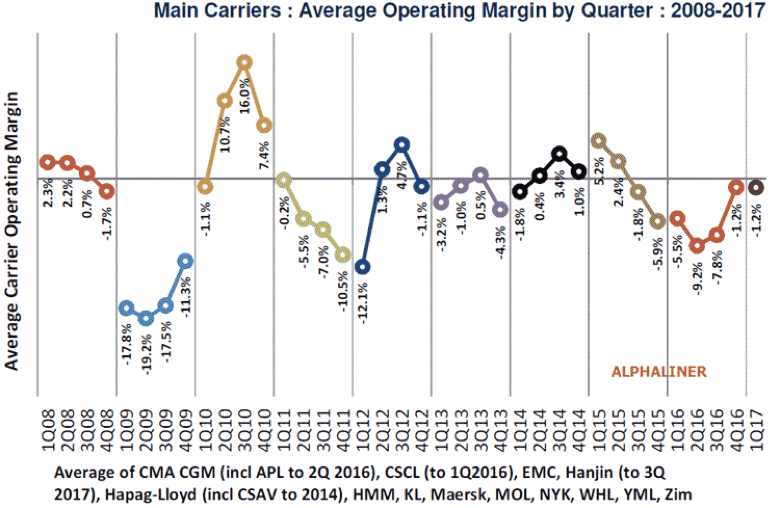

The main reason that ocean carriers’ service quality is decreasing is concerns for profitability. Except for a brief period in 2010, over the last 10 years, ocean carriers saw their collective operating income from the largest carriers in negative territory, or just barely above breakeven. Furthermore, operating income doesn’t even include other costs such as financing charges.

Bunkering represents 50-60% of a ship’s operating costs. So, any increase in oil prices has a much larger effect on carriers then the bunker cost increase that you see on your rates.

Additionally, environmental concerns create extra pressure on operating costs. The International Maritime Organization (IMO)’s Marine Environment Protection Committee will meet in London from Oct. 24th to 28th to decide whether to impose a global cap on SOx emissions from 2020, or 2025 onward. This would see sulfur emissions fall from the current maximum of 3.5% of fuel content to just 0.5%, which means higher “Low Sulphur Surcharges” for customers, and extra costs for carriers.

Ocean carriers also lost an important revenue factor – to be different, to offer something different.

From my point of view, there are two main ways for an ocean carrier to differentiate. One is people, and two is unique services.

In the last decade, ocean carriers’ “number of customers per sales person” ratio is increasing, which means sales representatives may show you very limited attention. And getting any attention will depend on whether you have a well-motivated sales representative that sees value from your business and is a good fit. In the current market, most carriers give you either a single rate sheet, or require that you make your requests to an automatic email address, unless you have a large volume.

On the customer service side, in the old days, customer service/operations staff within carriers would know their customers by name, understand their needs, and act accordingly. Ocean carriers continuously lose that as they go through restructuring, mergers, and the outsourcing of roles to other countries.

From the unique services perspective, years ago, a direct ocean carrier would be able to ask higher freight for better transit time. They would have niche areas in which they solely operate. Today, with overcapacity and high transshipment costs, direct services are primarily for ocean carriers to cut costs, rather than create value. And, with the alliances, they cannot really keep it within themselves.

As a part of the shipping community, we also have our own struggles with them. But, honestly, I do not blame carriers.

At the end of the day, they struggle to differentiate, but do they really need to differentiate? In the past, there were 20-25 carriers, while today there are only 10-12 carriers left. They do not operate from every port. So, if you look at a lane by lane perspective, you would see maybe 3-4 major carriers per lane, with 1-2 sailings. Regardless if you like their service or not, you will be required to get their boat one way or another.

On top of that, ocean carriers’ main business is moving containers on the water. So, why should our trucking and chassis problems be their problem? Why would we need them to increase our visibility or communication with our international counterparts? As the overall logistics community, there are many solutions to our problems, so perhaps we should not expect ocean carriers to solve these issues on their own.

To conclude, cost-driven decision making is the reason why carriers are losing their service quality.

As an overall industry, we also expect too much from ocean carriers, rather than cooperating with the experts of those specific solutions we are looking for.