Ocean shipping carriers are getting creative in this era of all-time high rates.

Recently, carriers have come up with many different creative names for surcharges on top of already all-time high freight rates, a practice which is putting extra pressure on many small to midsize importers. Ocean carriers are the only ones that seem to be taking advantage of these unprecedented times. It all started with the consolidation of the carriers, followed by disciplined capacity management, and blank sailings where carriers controlled vessel space and regardless of how low volumes were, carriers were able to keep the rates at certain levels. Finally, COVID-related pent up demand hit and there was no stopping rate increases and endless surcharges, premium fees, etc. from that point on.

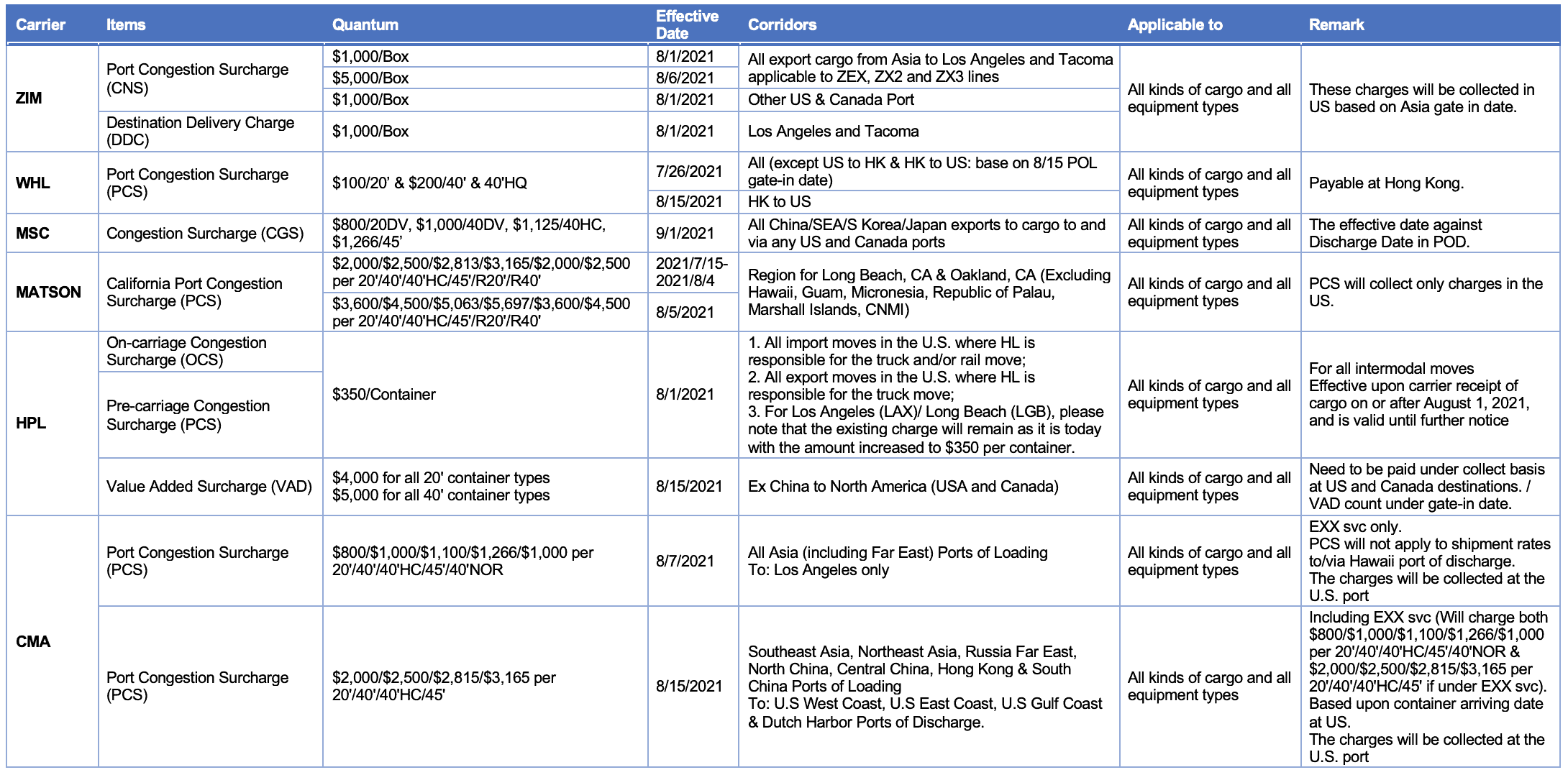

The most recent new gimmick is the “port congestion fee” and as far as we are informed so far, some carriers will implement this based on the arrival date of the vessel which will make cost planning for the many importers more difficult. So far, the following carriers announced the port congestion fee with below quantum levels:

I have been talking to many importers day-to-day and they all have the same challenges and problems.

Right now, the main challenges and problems are:

- Sky high ocean freight rates

- Unreasonable charges sought by ocean carriers

- Lack of equipment and space

- Unreliable service loops

- Constant delays

- Port congestion

- Lack of truck power

Most of the above issues do not have quick fixes and they are related to fundamental issues.

These are all related to the existing issue of lack of enough supply and unprecedented demand from importers all around the country. These have been discussed many times on different platforms. The situation we are in will not get better anytime soon and all stakeholders should get ready for the current situation to worsen over the next few months. Additional capacity will not be available until the end of 2022 and getting back to normalcy is not expected until Q1 2022, when the current panic buying from importers ends or many companies simply stop buying.

The current situation is the strongest evidence that the shipping industry must work as one. Importers should not take care of the situation by pushing carriers to their limit with rates and carriers should be more reasonable when the market tides shift to their advantage. There needs to be market equilibrium where both parties are happy and that is the only way to have a healthy supply chain flow.

This whole volatile situation poses another risk.

Small to midsize freight forwarders that don’t have strong financials will definitely be affected by this situation. Financially, it will be a huge burden on those companies and we may see those companies go under as a result of high freight rates. Alternatively, they will simply lose their competitiveness or drop some particular trade lanes. As a result, this will open a whole other can of worms.