Having been working in the supply chain and logistics industry for a long time, I’ve learned about some clear facts about the industry, and business in general.

- Shipping requires seasoned shipping experts.

- Profit margins for freight forwarders and logistics companies typically fall within the range of 5% to 10%

- A constant awareness of costs is imperative.

- Technology should complement, not overshadow, the core product.

- This business is service-oriented – real people are indispensable.

- Success demands hard work and there are no shortcuts.

In the mid-2010s, the supply chain and logistics industry saw many advocating for technological disruption, with claims that traditional companies were struggling to adapt. The influx of funding (driven by low interest rates across the world) in the following years led investors to scout out and invest in potential “unicorns” starting around 2015.

How did valuations and investments in the supply chain and logistics industry change during the “unicorn” era?

During this “unicorn era”, the narrative shifted from traditional valuations of logistics companies to an era where tech-infused logistics entities were deemed worthy of significantly higher valuation.

In the shipping industry, where companies were typically valued by an EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiplier of 4x to 15x, these so-called “tech” companies managed to convince investors that a multiplier as high as 10x on their Gross Sales (not EBITDA) was justified even though they serve the same purpose as traditional companies. To provide perspective, in a scenario where a freight company has a 9% profit margin on revenue of $500 million, the resulting gross profit would amount to $45 million. Assuming its EBITDA is $40 million, the valuation would hover around $400-500 million. Conversely, if an identical company adopts a tech-oriented identity, its valuation could escalate to $5 billion.

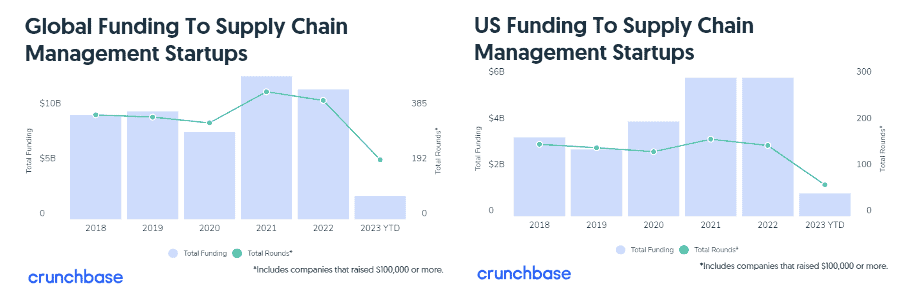

From 2018 to 2022, a staggering $50 billion was invested in logistics and supply chain startups.

Based on their multipliers, their projected profits were 25% to 30% – three or four times more than “traditional” companies. So, a big question arose: Why should customers pay more for these services, and how do these companies enhance cost savings or revenue generation?

In the beginning we were all quite skeptical, and the feedback we were getting back was showing our doubts were correct. Nothing was different than what is already been provided. If many of us could see that these business models would fail, how come they survived so long?

Unfortunately for investors, the onset of the Covid pandemic supercharged the industry’s profitability, which let these companies be profitable over those two years. This unanticipated success attracted even more investments from numerous investors.

What happened recently in the supply chain and logistics industry after interest rates rose?

As interest rates rise and market projections remain uncertain until the end of 2025, reports of these once-lauded unicorns faltering, laying off employees, and closing their doors are emerging. The era of unicorns in the supply chain and logistics industry appears to be waning. It is time for them to ground their soaring ambitions and confront realities.

Established companies, often labeled as uncool or traditional, have demonstrated a healthy balance and understanding between the benefits of technology and the importance of human expertise. Established companies recognize that the supply chain and logistics industry is cyclical and have adopted smart hiring practices and managed their businesses based on facts rather than dreams.

Regrettably, the true victims of this unfolding scenario are the individuals losing their jobs. As the industry grapples with shifting dynamics, it underscores the importance of grounded, sustainable business practices that prioritize the well-being of its workforce over fleeting dreams.