Steamship lines have halted transits via the Suez Canal as the Houthi militants continue their attacks in the Red Sea.

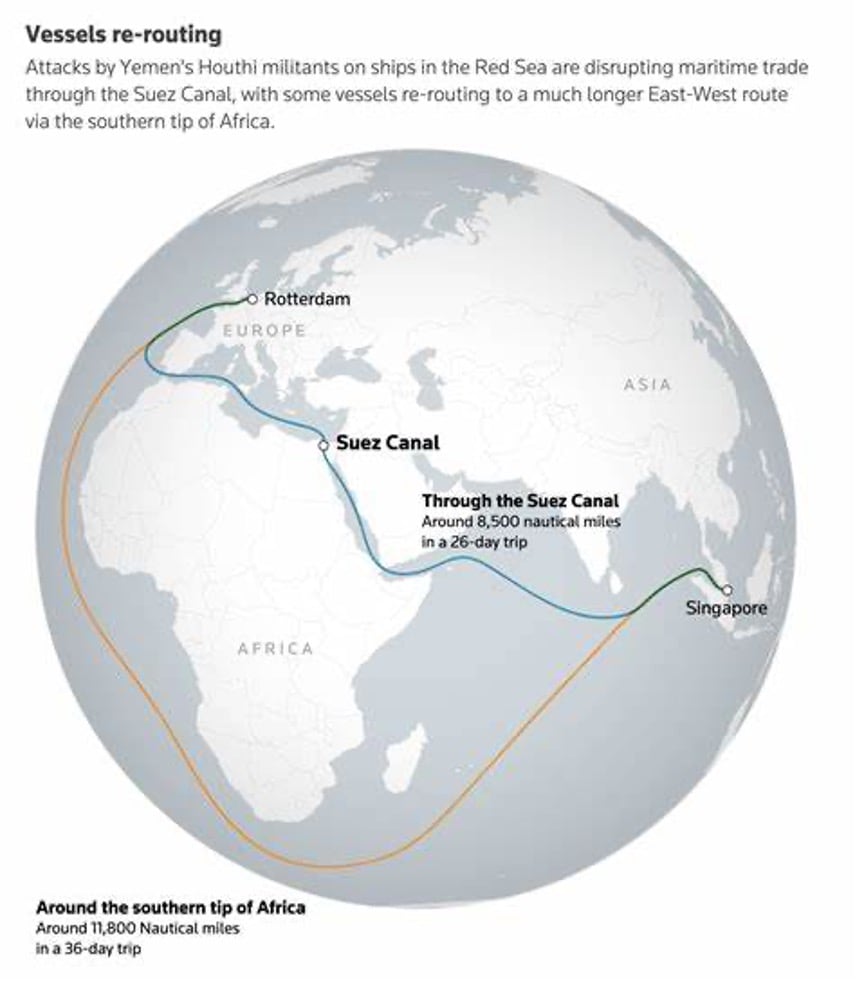

The issues center mainly near the Bab-el-Mandeb Straight, also known as the Gate of Tears, a choke point where 12% of global trade passes through. Carriers are now scrambling and adjusting shipping routes. Instead of carriers passing through the Suez Canal, ships are heading south to sail around the Cape of Good Hope in South Africa. This is having severe effects on transit times and shipping costs around the world. For the near term, a few trade lanes are already seeing an immediate doubling in ocean freight costs. To offset their costs, carriers will continue to implement new rounds of surcharges.

The longer voyages from these diversions are causing ocean rates to spike. In addition to added transit times, these diversions are increasing carriers’ carbon emissions tax, equipment imbalances, and most importantly additional, higher fuel costs. It has been estimated, that for such diversions for the re-routing via the southern tip of Africa, there is an estimated $1-2 million in added fuel costs for the round trip from Asia and North Europe.

Trade routes from Asia to North Europe and the Mediterranean have seen the most drastic week-to-week changes in spot market container freight. For instance, Shanghai to Rotterdam has increased 115% from $1,677/FEU on December 21st to $3,577/ FEU beginning January 4th. From Shanghai to Genoa, for example, the weekly change in rate has increased from $1,956/FEU to $4,178/FEU according to Drewry Supply Chain advisors.

What comes next for rates and the industry?

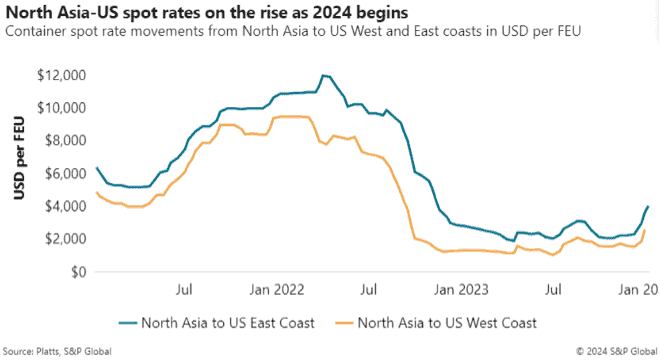

For the second half of January, we can expect spot rates to continue their climb to yearly highs. In the Asia to U.S. market, there is a cargo rush with the Chinese New Year a few weeks away. Also, due to the ongoing drought issue at the Panama Canal, we are facing vessel and equipment imbalances which are pushing up the container spot rates.

Carriers are now quoting $5,000/FEU from Asia to the U.S. West Coast with effective date January 15th. Therefore, we can expect to see U.S. East Coast and Gulf Coast rates climb to $7,000/FEU.

Historically, the gap between U.S. West Coast and East Coast rates has been around $1,000/FEU. Considering that around 30% of the cargo destined to the U.S. East Coast traverses via the Suez Canal, many industry experts anticipate much of this volume will be diverted to the U.S. West Coast via Transpacific services. This will add a much-needed boost for trucking and rail providers, while lifting the need for transload facilities in this region.

Under the U.S. Shipping Act, carriers must provide a 30-day notice for surcharges such as General Rate Increases (GRIs) and Peak Season Surcharges (PSS), but due to the Red Sea crisis showing no signs of slowing down, the Federal Maritime Commission has waived this requirement. A few not-so-common surcharges already in effect are the Contingency Adjustment Charge (CAC) by MSC which adds $1,500/FEU to base rates and Maersk’s Transit Disruption Charge (TDS) for an additional $400/FEU, both from Asia to the U.S. From the Middle East/Indian Subcontinent to North America, MSC announced a $1,600/FEU as an Emergency Contingency Surcharge (ECS).

As summarized by Drewry in their January 5th weekly analysis:

“Red Sea delays and ship diversions may result in port congestion, leading to equipment shortages, sailings gaps and disruption to global supply chains, which will take weeks or months to recover. The next five weeks leading up to Chinese New Year (on February 10) are expected to be especially challenging for shipping, with delayed and misplaced shipments, but there is confidence in the industry’s ability to reroute ships around the Cape of Good Hope, and it is anticipated that spot rates will decrease after Chinese New Year.”