The container equipment shortage, which we started to feel as of last month, has been felt more intensely lately.

The return to normal trade routes after the Covid pandemic has been hampered by various factors, including human and environmental challenges, leading to occasional inefficiencies in shipping operations.

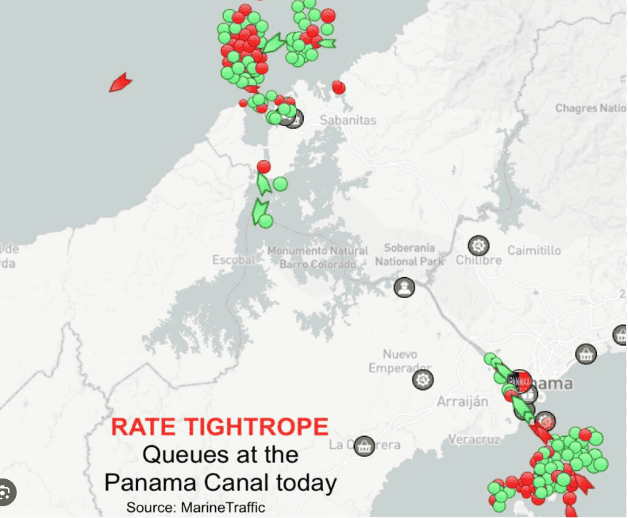

This situation has resulted in congestion at channel entries and ports. Naturally, these disruptions have a domino effect on the interconnected aspects of overall trade, affecting even small-scale shippers.

To summarize, the causes of the shipping equipment crisis can be categorized into three main factors, as outlined below.

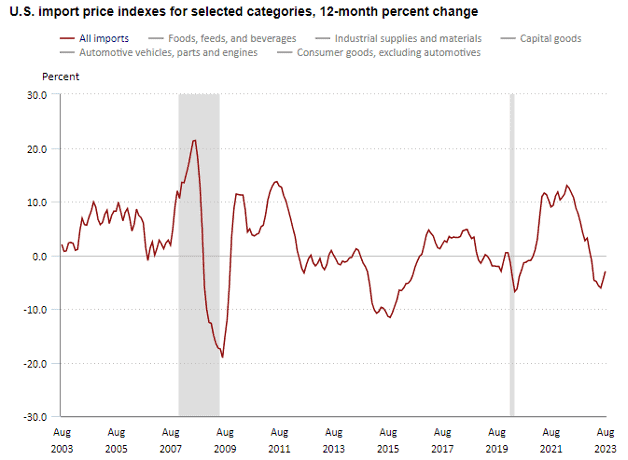

1. A Decrease in U.S. Import Levels

The reduction in U.S. import levels directly impacted the number of containers coming in. We are now receiving fewer containers, and when these containers are returned empty, the equipment ratio at the empty depots is lower compared to previous periods.

2. The Crisis at the Panama Canal

The crisis at the Panama Canal has caused delays in the transit of containers to U.S. ports.

3. A Decrease in Freight Rates

The overall reduction in freight rates led to a decrease in U.S. voyages, further exacerbating the shortage of available equipment.

This equipment crisis is directly affecting the operations of exporters and forwarders, leading to a significant increase in “SPLIT / ROLL” situations.

Moreover, due to the equipment shortage, products scheduled for export cannot meet their agreed-upon dates. Naturally, this situation leads to disagreements between parties, with container-finding exporters avoiding returning containers empty, even at the cost of paying additional fees.

In light of this challenge, collaborating closely with forwarders could offer a solution.

Forwarders possess more trucking capabilities compared to what individual exporters can access. Additionally, forwarders can utilize the import containers in their truck fleets for exports through “STREET TURN,” potentially mitigating some of the logistics issues we are facing.