As the market continues a downward trajectory in transpacific eastbound spot rate, I can’t help but think about the commonalities between COVID-19 and the rate war which resulted in the Hanjin bankruptcy of 2016.

COVID-19 and Hanjin’s bankruptcy both have had significant impacts on the global supply chain and share commonalities in the following ways:

- Disruptions to global trade: both events led to delays and increased costs for shippers and manufacturers who had to find alternative ways to transport their goods.

- Ripple effect through global supply chains: both events forced companies to scramble to find alternative carriers to reroute their shipments, leading to increased costs and disruptions to the timely delivery of goods.

- Uncertainty and volatility: both events caused businesses to reconsider their contingency plans, strategies, and priorities.

- Increased focus on flexibility: both events emphasized the need for a more resilient and stable global supply chain, leading companies to consider alternative sourcing options, diversifying their supply chain, and improving their risk management strategies.

The Breakdown

The shipping industry is complex and subject to many economic and geopolitical factors that can impact supply and demand, and ultimately, shipping rates. Although there are indicators which signal another rate war is on the horizon such as sudden and steep cuts in shipping rates and an overcapacity of ships. This would lead to market instability as carriers would continue to undercut each other in hopes of gaining market share, even leading to negative impacts on profits such as in Hanjin’s case.

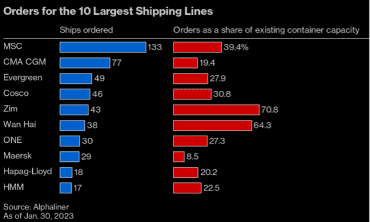

The market is leading to an overcapacity of supply, with the current containership order book at 7M TEU’s. Around 2M TEUs of vessel capacity is scheduled for delivery this year and the remaining 5M TEUs worth in 2024. This overcapacity, combined with slow global economic growth, could lead to increased competition and pressure on shipping rates.

In Conclusion

In summary, while it is difficult to predict whether the current market conditions are prone to another rate war in ocean shipping, the likelihood of increased competition and market pressure is always present. It will be interesting to see whether companies fully return to the Just-in-Time shipping model with the easing of rates and operational pressures or lean more towards a Just-in-Case model due to the looming risk of supply chain disruptions.