For the last 1 to 1.5 years, we have all read about the problems with shipping containers and supply chains.

The hottest topic is imports from Asia to the U.S. Prices are going up, West Coast ports are completely congested, rail ramps cannot handle the work, there are trucking challenges, etc.

As prices and delays on the U.S. West Coast climbed and fluctuated at a median rate of suffering, we started to feel the pressure on U.S. East Coast ports. Those ports also peaked and multiple carriers stopped calling the Port of Savannah with major vessel sailings.

While all these developments were taking place, exports from the U.S. Gulf Coast experienced little to no issues until Summer 2021.

Since Summer 2021, U.S. Gulf Coast exports started to feel the pressure, too, and the U.S. East Coast peaked. Interestingly, if we ask an exporter how busy they are today compared to last year, they will likely say they are swamped right now.

According to data from Datamyne, for the second half of 2022, if you are in Houston or in New Orleans, space/equipment/trucking/chassis availability should be quite calm – based on the numbers only. This is based to the fact that the Port of Houston has shipped 17.5% less cargo from June 1st to Dec 28th of 2020/2021 and New Orleans has shipped 21% less cargo during the same period.

Despite some glimmers of hope, we all know we are far from being calm. So, the question is, why there are less containers getting exported if everyone is so busy?

Importers are now utilizing U.S. Gulf and East Coast ports more (to diversify the risk with California ports.) As of September 2021, year-to-date, the Port of Houston had 16% more import volume than in 2020. So, imports are significantly up, so warehouse space became limited, trucking availability got poorer, and dwell times for import containers have doubled from 4.5 days to 9 days for the Port of Houston. These numbers basically double the pressure on chassis, container availability, and export trucking.

Import freights are significantly higher-paying than exports, so the main carrier strategy is based on imports. If a transshipment port will be skipped to catch up with the schedule, it becomes the problem of exports because carriers decide not to call one of those transshipment hubs and they don’t pick up the containers at the loading ports.

In connection with vessels, one of the worst problems today is carrier/terminal earliest receiving and vessel cut-off dates. There are many cases where carriers provide you dates that are completely different from the terminal, and even different than a partner carrier that is on the same vessel. When exporters need planning the most, to coordinate their warehouses and truckers, they cannot plan anything at all because even vessel owners don’t know their vessels dates.

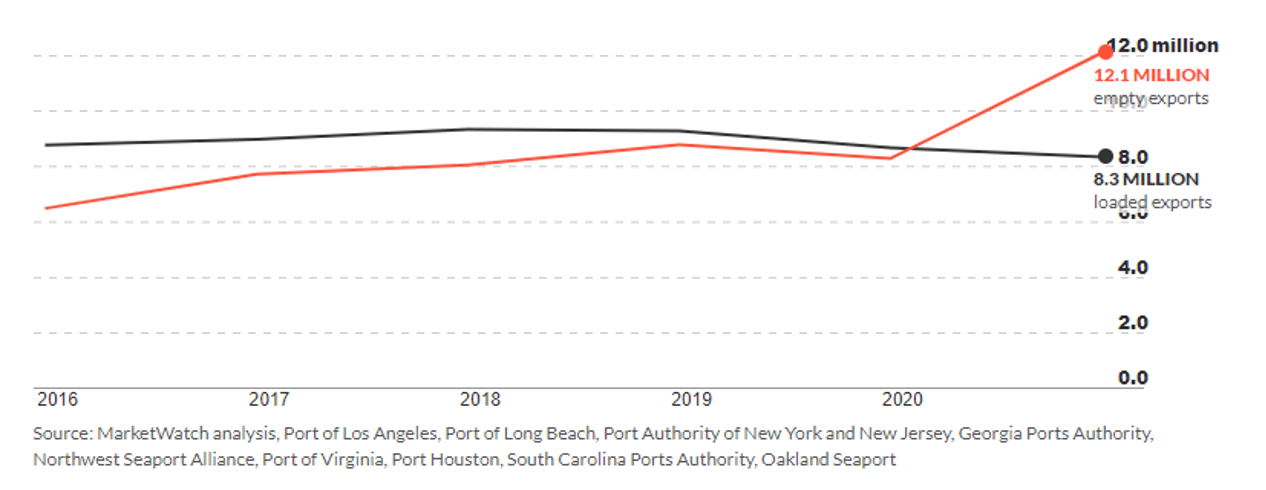

Another strategy of ocean carriers is filling the the vessels by “repositioning empty containers.” According to a MarketWatch analysis, 46.2% more containers shipped empty in 2021 than in 2020, which is an extremely significant number considering this number usually stays around 8 million TEUs on average. So, this is one of the primary reasons why exporters cannot find space at their loading ports or rail ramps especially for trades going into Asia.

Lastly, in the U.S. Gulf, at least until end of the third quarter of 2021, certain commodities like resin were not strong enough. Resin exports started to soar which brought in the pressure. However, because of the problems that we already started to see in the U.S. Gulf, ports like Houston still stayed 11% behind even for the last quarter when you compare the numbers with the last year.

As we can see, all the basics for the perfect storm in shipping are ready and in place.

Strong imports, equipment/chassis/trucking challenges, lack of vessel space, and vessels that are completely out of their schedules have already been problems. Now, on top of all these elements, interest rates will be increasing in the U.S. that will stabilize domestic demand, so more commodities will be available for exports. U.S. export prices will become more competitive, which means there will be more cargo to export.

So, if you think that we are at the peak of our problems to export, I think we should all wait and see mid-2022.